Table of Content

An addition five thousand dollars is available, too, according to the bill’s draft version. The Home Buyer’s Plan allows you to withdraw before-tax contributions to your RRSP for your down payment. This can allow you to save significantly more for your down payment than you would be able to with after-tax income.

You are a displaced homemaker who has only owned a property with your former spouse. You are a single parent who has only owned a property with your ex-spouse when you were married. Be smart when it comes to your FHA loan and your financial future. A good FICO score is key to getting a good rate on your FHA home loan. A lease contract will establish the conditions of sale, as well as the total price and cancellation period of the property. Flood insurance is recommended for homes in flood-prone areas.

Make an offer

This takes the form of a second mortgage of up to 3.5% of the homes purchase price, or $11,000 for FHA loanfinanced homes whichever is less. The government-sponsored enterprises Fannie Mae and Freddie Mac set borrowing guidelines for conventional loans theyre willing to buy for the secondary mortgage market. With a 3 percent minimum down payment, these programs are an affordable option for borrowers with a strong credit score and a lower down payment. Of course, some homeowners will qualify for more and some less. The only way to know how much help youre in line for is to find local down payment assistance programs in your area and apply. Buyers can also use theHomePath Ready Buyer programand receive a 3 percent cash contribution toward the mortgage closing costs.

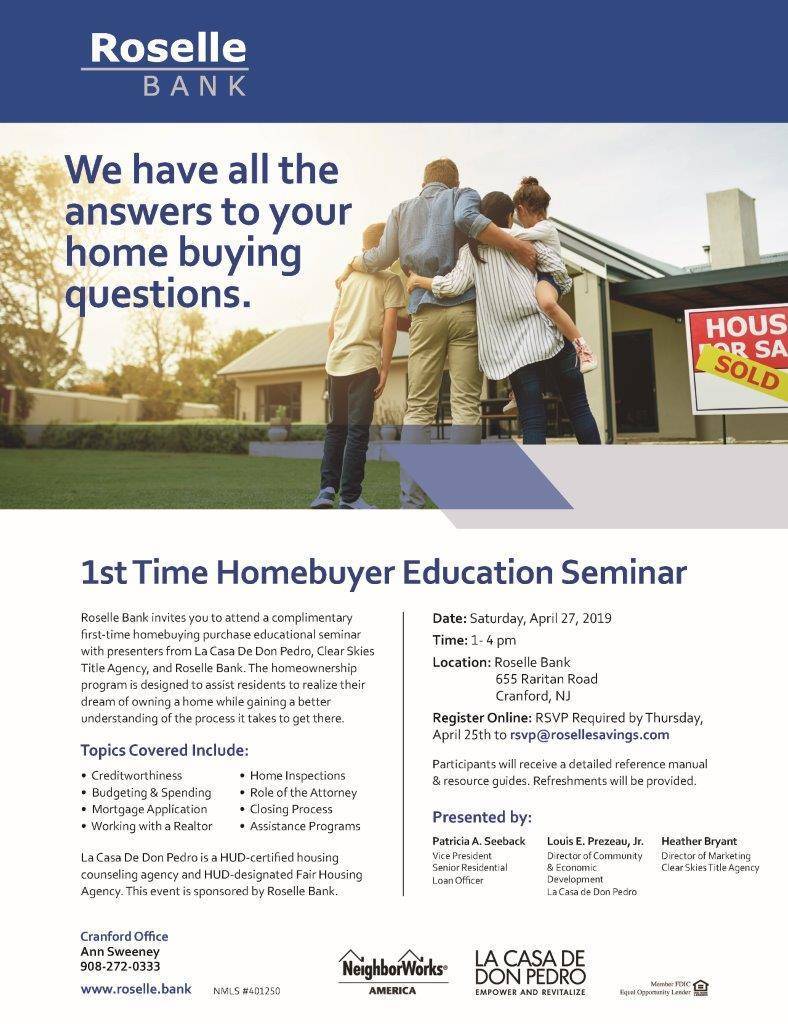

To apply for an FHA-insured loan, you will need to use an FHA-approved lender.Search for an FHA-approved lender here. The program provides public housing residents and others with a low income who are first-time homebuyers with subsidies to use toward buying a home. For additional information about this program, contact your local Public Housing Agency . In addition, government first-time home buyer grants often require borrowers to complete some form of homebuyer education course. The downside is that, with an FHA loan, you’ll have to pay an upfront mortgage insurance premium along with annual premiums that are paid monthly. This mortgage insurance will usually need to be paid until you pay off your mortgage or refinance into a different loan type.

First-Time Home Buyer Grants and Programs in 2022

Lenders Most often Require you to buy homeowners’ insurance To help protect your investment Yours and theirs. The homeownership gap between white and Hispanic households is currently 25 percentage points, and the difference between white and black households is currently 30 percentage points. Also take a look at HUDs list of alternative programs for California. When you decide on a home you like and make an offer, have the home thoroughly inspected. You want to make sure there arent structural issues or anything else that could affect the livability of your new place. Inspections usually take a few hours, and cost a few hundred to a few thousand dollars, depending on the size of the home.

The agency said the State’s housing crisis can be traced back to a “decade of underinvestment” after the 2008 property crash. While the population grew by 263,000 between 2009 and 2017, the housing stock grew by just 35,000 units. Home Loan Experts is a business owned by mortgage broking firm Home Loan Experts Pty Ltd. Our relationships with our panel of lenders allow us to negotiate your interest rate. A $10,000 FHOG to buy or build a newly built residential property for use as their principal place of residence.

First-Time Home Buyer Government Programs 2022 Updates

This scheme allows eligible first-home buyers to purchase a new or existing home with a deposit of just 5%, without paying tens of thousands of dollars in Lenders Mortgage Insurance . Public servants can buy affordable homes through the Good Neighbor Next Door Program run by HUD. It is possible for them to finance properties for as little as $100 down and get them for 50% off retail.

The amount of Stamp Duty Land Tax you pay for a First Home is based on how much you paid for the home after the discount was applied. On the completion date, your conveyancer transfers the money from your mortgage to the developer, you get the keys and can move in. You need to pay your deposit at the same time as you exchange contracts with the developer.

Government First Time Home Buyer Programs

The homes cannot cost more than £420,000 in London, or £250,000 anywhere else in England, after the discount has been applied. Gov-Relations is where people may seek information on funding opportunities. With our help, we hope our readers are reducing paperwork and simplifying their grant application procedure. We provide data quality reviews, assistance, and informative articles to assist applicants in their journey to completing and submitting grant applications. A copy of the HUD certification is mailed to the homeowner annually, which they must sign and return. Let us know about your experiences in the comment section below.

They are provided to qualified borrowers, including first-time home buyers and repeat buyers, by the NHF as a nonprofit public benefit corporation. The Help to Buy scheme allows first-time homebuyers to pay a 5% deposit. Buyers are able to borrow 20% of the home’s cost—or 40% if you live in London—without interest for the first five years of the loan. First-time buyers are often encouraged by federal governments to climb onto the property ladder and offer assistance. One such program is called Help to Buy in the United Kingdom.

Get pre-approved and let your lender advise you on which mortgage loan is best for you. Home buyers can use grant monies to make a down payment, pay closing costs, cover state and local taxes, andlower their mortgage ratewith discount points. The Downpayment Toward Equity Act of 2021 is a cash grant for first-time home buyers. Dan Green is a former mortgage loan officer and an industry expert. He’s appeared on NPR and CNBC, and in The Wall Street Journal, Bloomberg, and dozens of local newspapers. Dan has helped millions of first-time home buyers get educated on mortgages, real estate, and personal finance.

Some companies in the Frankfurt/Rhine-Main, Germany might also offer long-term incentives such as stock options or stock grants for Entry Buyers. Other popular benefits are gym memberships, free parking, monthly car expenses, free food, and company discounts. Evaluate all offered benefits to determine if they are of value to you. Consider items that you value and see if you can negotiate favorable terms for them. For example, request an extra week of vacation, reimbursement for training, flexible work hours, or subsidized parking. These perks have a value that should be included when you evaluate the entire compensation package offered to you.

If you don’t want to spend a lot of money on your home renovations or improvements, you might look into section 203 FHA loans. After the improvements are made, the loan calculates your home’s worth. They will then calculate the value of your home after all improvements have been made. They will lend you money to pay for renovations and let you pay them in small installments. You will be required to make a 3.5% deposit and upgrade must exceed $ 5,000 in order to apply.

No comments:

Post a Comment